Salary Packaging

Why pay more tax than you have to?

How does salary packaging work?

Salary packaging can seem complicated at first. At Maxxia, we’ve been helping Australians understand salary packaging for more than 30 years, so let’s see if we can simplify it.

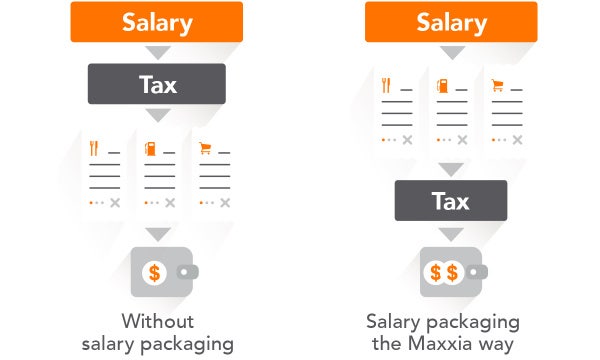

In an ‘ordinary’ situation (without salary packaging), your employer takes out income tax from your pay and the remaining after-tax amount is deposited into your bank account. You then pay for all your usual living expenses with this money. As a Qantas Group employee, you have the opportunity to salary package certain eligible items.

This means your taxable income could go down, your disposable income could go up, and by salary packaging the cost of these items, you could have more money for other essentials.

It’s no surprise that over 230,000 of Australians currently enjoy the benefits of salary packaging with Maxxia.

What can I salary package?

As a Qantas Group employee, you have the opportunity to salary package:

-

A car through a novated lease

-

One of each type of the following portable electronic devices per FBT year (1 April – 31 March), on the basis that these devices will be used primarily for work purposes:

- Smart Phone (to the extent one is not already provided to you for use by the Qantas Group);

- Smart Watch;

- Tablet;

- And Laptop (eligible employees only).

-

Self-education expenses that relate to your job, including:

- Courses or seminars;

- Journal subscriptions;

- New reference books.

-

Other work-related expenses, including:

- Home office (including stationery, a leased or rented computer, home office repairs & work-related software);

-

Professional memberships and subscriptions, including:

- Newspaper and magazine subscriptions;

- Professional memberships and subscriptions;

- Club memberships.

Salary packaging has many benefits, salary packaging with Maxxia has many more

FAQs

How will salary packaging affect my pay?

Here’s what happens once you've set up a Maxxia salary packaging account:

- each pay cycle, your employer's payroll department deducts a nominated portion of your salary before tax is applied – and sends those funds to us

- you can then use these funds to pay for your chosen benefits (e.g. Living expenses, Mortgage payments)

- the rest of your salary gets taxed. However, because some of your salary has been taken out (to pay for your chosen expenses), you may be taxed on a lower amount

- your post-tax salary is then deposited into your bank account as usual.

By getting taxed on a lower amount and effectively paying less tax, your disposable income could be increased. This could leave you with more to spend at each pay cycle.

Is salary packaging difficult to manage?

No, we take care of the hassles so enjoy the benefits. After we set up your salary packaging arrangements, we also manage them for you. This means that we pay for your nominated expenses on your behalf – using your pre-tax dollars. No more juggling bills and due dates!

In exchange for managing your salary packaging account, we charge an administration fee that is dependent on the benefit and agreed upon with your employer. All fees are paid out of your pre-tax dollars and don’t contribute to your salary packaging cap limit or attract FBT.

Maxxia App / Maxxia Online

While we pay for your expenses on your behalf, it’s important you know what's being paid and how much is in your salary packaging account at any time. My Maxxia is accessible 24/7 and allows you to:

- view your transactions

- view your account balance

- change your details

- submit reimbursement claims

Why should I salary package?

Employers offer salary packaging to reward staff for their loyalty and hard work, but it’s not a benefit offered by all companies. So if you’re one of the lucky ones, we’ll take you through the many advantages of salary packaging.

Reduce your taxable income

We all want to pay less tax, right? With salary packaging you potentially can, by paying for some expenses with your pre-tax wage.

When you salary package, you’re still paying for your usual expenses, but with pre-tax dollars – meaning you are reducing your taxable income and, in turn, potentially increasing your disposable income.

Enjoy more spending money

At each pay cycle you could have more money to spend on the things you want – such as new clothes or a well-deserved weekend away. The choice is yours.

Save on the cost of running your car

By salary packaging a car through novated leasing, you could reduce the cost of keeping your vehicle on the road – and, perhaps, finally afford your dream wheels. Basically you bundle the lease and the car’s running costs (including fuel, registration, insurance, servicing and maintenance) into one regular payroll deduction. And because you’re using a combination of pre- and post-tax dollars, you’re not only saving time but money, too. You don’t need a huge income to benefit, and you can package a new or used car, or even your existing vehicle (if eligible).

Important Information

This general information doesn’t take your personal circumstances into account. Please consider whether this information is right for you before making a decision and seek professional independent tax or financial advice. Conditions and fees apply, along with credit assessment criteria for lease and loan products. The availability of benefits is subject to your employer’s approval. Maxxia may receive commissions in connection with its services.

Maxxia Pty Ltd | ABN 39 082 449 036.