How does salary packaging work?

Salary packaging can seem complicated at first. At Maxxia, we’ve been helping Australians understand salary packaging for more than 30 years, so let’s see if we can simplify it.

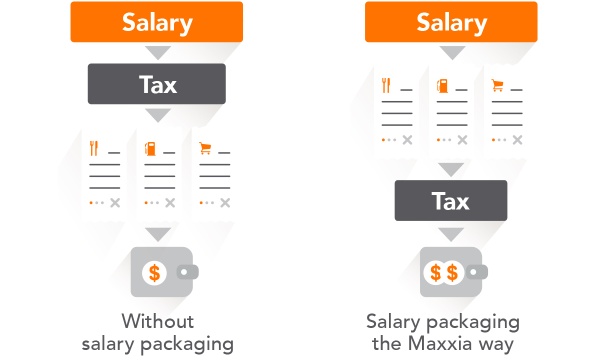

In an ‘ordinary’ situation (without salary packaging), your employer takes out income tax from your pay and the remaining after-tax amount is deposited into your bank account. You then pay for all your usual living expenses with this money. As a Qantas Group employee, you have the opportunity to salary package certain eligible items. This means your taxable income could go down, your disposable income could go up, and by salary packaging the cost of these items, you could have more money for other essentials.

It’s no surprise that over 230,000 of Australians currently enjoy the benefits of salary packaging with Maxxia.

What can I salary package?

As a Qantas Group employee, you have the opportunity to salary package:

- A car through a novated lease

- One of each type of the following portable electronic devices per FBT year (1 April – 31 March), on the basis that these devices will be used primarily for work purposes:

- Smart Phone (to the extent one is not already provided to you for use by the Qantas Group);

- Smart Watch;

- Tablet;

- And Laptop (eligible employees only).

- Self-education expenses that relate to your job, including:

- Courses or seminars;

- Journal subscriptions;

- New reference books.

- Other work-related expenses, including:

- Home office (including stationery, a leased or rented computer, home office repairs & work-related software);

- Home office (including stationery, a leased or rented computer, home office repairs & work-related software);

- Professional memberships and subscriptions, including:

- Newspaper and magazine subscriptions;

- Professional memberships and subscriptions;

- Club memberships.