What is novated leasing?

If you could pay less tax, get a great deal on a new car and enjoy the budgeting convenience of having your finance and running costs covered in one regular payment, why wouldn’t you?

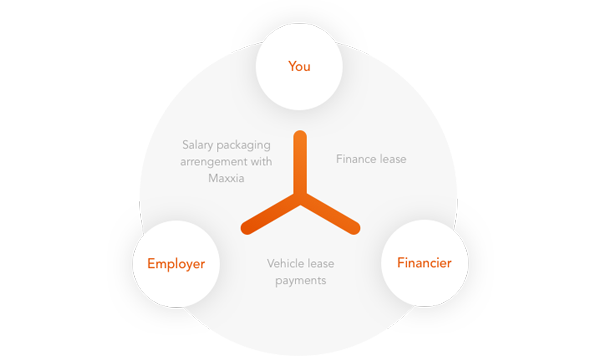

Available on new, used and even some existing cars, novated leasing is an ATO-approved arrangement between you, your Qantas Group employer and a finance company that lets you use pre-tax dollars to pay for a car and its expenses.

Novated leasing also allows you to bundle not only your lease payments, but your car’s running costs – including petrol, charging (if yours is an electric vehicle), insurance, registration and servicing – into one convenient regular payment.

There are two types of leases available to Qantas Group staff. Refer to Qantas' FAQ's on Qantas Group intranet for further information.

- Fully Maintained leases, where Maxxia manages all aspects of your lease, including sourcing your vehicle and finance, plus the ongoing management of your budgets, payments and maintenance.

- Self-Managed leases, where you source your own finance, directly with a financier and not via a 3rd party leasing provider, manage your own budgets, deductions and payments and take responsibility for all risks associated with your lease.

How does novated leasing work?

With a novated lease you could get a new, used or existing car leased in your name, via the Qantas Group . Then, instead of paying for your lease with the money you have left over after tax, your lease is paid for via your payroll department with funds from a combination of your pre- and post-tax salary.

Novated leasing could reduce the cost of getting into and running your next car and potentially lower your taxable income.

You don't necessarily have to be a big earner or drive lots of kilometres to benefit, a novated lease could benefit almost anyone who needs a car. Best of all, with Maxxia you can rest assured you’ve got the life-of-lease support of Australia’s most experienced novated leasing provider.

If watching a video could help you pay less tax, why wouldn't you?

Different types of Novated Leasing

Novated Leasing - Financial Savings and Confidence